Enjoying the raise? Your future self will enjoy it even more.

Consider contributing some of your raise to your Deferred Compensation Plan. It can help you save more for your retirement, reduce taxes and multiply your savings through compound interest.

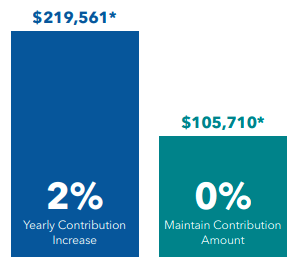

Even a 2% yearly contribution increase can add up over time:

For illustrative purposes only. Assumes a standard balance of 0%, annual salary of $70,000, $50 initial bi-weekly contribution and 6% average annual return over 30 years.

Ready to boost your contributions?

Complete the contribution change form by visiting MissionSquare’s City of Norfolk 457 Site and selecting “Enrollment/Change Form” under “Manage My Account.”

Not yet enrolled? Here's what you're missing:

- Convenient paycheck contributions

- No minimum contribution limits

- Taxes deferred until you withdraw or Roth options as well.

Enroll in the City’s 457 Deferred Compensation Plan

Enroll in the City’s Payroll Roth IRA

If you have questions or need information, contact Mackenzie Moss, MissionSquare Retirement Plans Specialist, at mmoss@missionsq.org.